A forex strategy is when a trader makes a systematic plan to determine when it is best to buy or sell a currency pair. Such strategies dictate what indicators are important to analyze, what timeframes the trader should use, and how they should view historical data. Different strategies offer different systematic approaches to the forex market, and no one strategy is guaranteed to win traders money without effort. In this article, we will go over the 10 best forex strategies for consistent profits. Read on to learn more.

What Is Forex Strategy?

A forex strategy dictates a trader’s systematic approach to trading in the forex market, offering a framework with which to work. For example, a trading strategy might tell them which of the three types of analysis is best suited for them, what time frames they are interested in, and even what currency pairs are best for them to trade in.

A good forex strategy also dictates the risk management techniques that traders need to use, such as anti-margin calls. It also influences all trading decisions, such as hedging in a negative margin. Basically, it gives traders a master plan from which they can start as a first step and change the details based on market conditions. Understanding what a forex strategy for beginners is can help new traders avoid emotional decisions and focus on building a disciplined, rules-based trading approach.

Keep in mind that top trading strategies in the forex market don’t work without the trader’s own analysis. They only offer a framework for thought, and the rest is on the trader’s persistence, analysis, and risk management.

1. Trend Following Strategy

In the trend following strategy, traders use tools like moving averages and trendlines to identify and trade in the direction of the market. By using the trend following strategy, traders are able to spot upward or downward trends. For example, if a trader sees a EUR/USD pair exhibiting constant upward movement, they might want to enter a long position since one can anticipate the trend to continue.

The trend following strategy is based on the principle that markets tend to move in trends rather than unexpected movements. Traders can use indicators such as Moving Average Convergence Divergence (MACD) and the Average Directional Index (ADX) to confirm the approximate strength of a trend. Many traders rely on a forex strategy chart to visualize price movements, trendlines, and key levels before placing trades.

For instance, if a 50-day moving average goes over the 200-day moving average, traders can figure that it’s best to consider long positions since the evidence shows the beginning of an upward trend. On the other hand, if there’s a downward trend, traders might hold short positions.

To effectively implement your Forex strategy, understanding the concept of lot sizes in Forex is crucial for managing risk and optimizing profits.

2. Scalping

Scalping is a trading strategy that is short term and fixates on making smaller trades in large numbers to accumulte profit. Through this strategy, traders try to enter and exit positions within minutes. So, in each trade, the trader has to capitalize on very small price movements, such as a 5-pip movement in the GBP/USD pair multiple times a day.

To effectively implement this strategy, you need to have an enormous time commitment to the forex market, making trades all day. You also need to be able to make decisions quite quickly while constantly monitoring the market closely to identify opportunities. Currency pairs with high liquidity, such as EUR/USD or USD/JPY, are more popular among those using the scalping technique because of the tight spreads and frequent price movements.

Scalpers also use technical indicators such as the Relative Strength Index (RSI) and Bollinger Bands to identify the conditions that are overbought or oversold. This way, they can easily and swiftly enter and exit trades.

What Are Fibonacci Retracement Levels?

3. Swing Trading

In swing trading, traders try to get profits in a few days or weeks. They try to identify broader trends and identify price swings that happen in the time frame of weeks. These traders rely heavily on technical analysis and Forex market predictions to determine when to enter or exit positions. They also use other tools as well such as Fibonacci retracements (which we will explain later in this article) and moving averages.

An example includes a USD/JPY pair that retraces to a support level within an uptrend. In such a scenario, swing traders usually enter a long position to target the next resistance level. Using swing trading, traders can benefit from short-to-medium-term price movements. The upside is that they don’t need to constantly monitor the market.

Swing traders have to be patient and disciplined. They need to be able to hold positions overnight or over several days. Holding positions in these time frames requires patience and discipline since they will be exposed to market gaps and news events. Proper risk management strategies that they can use include stop-loss and take-profit orders to mitigate potential losses.

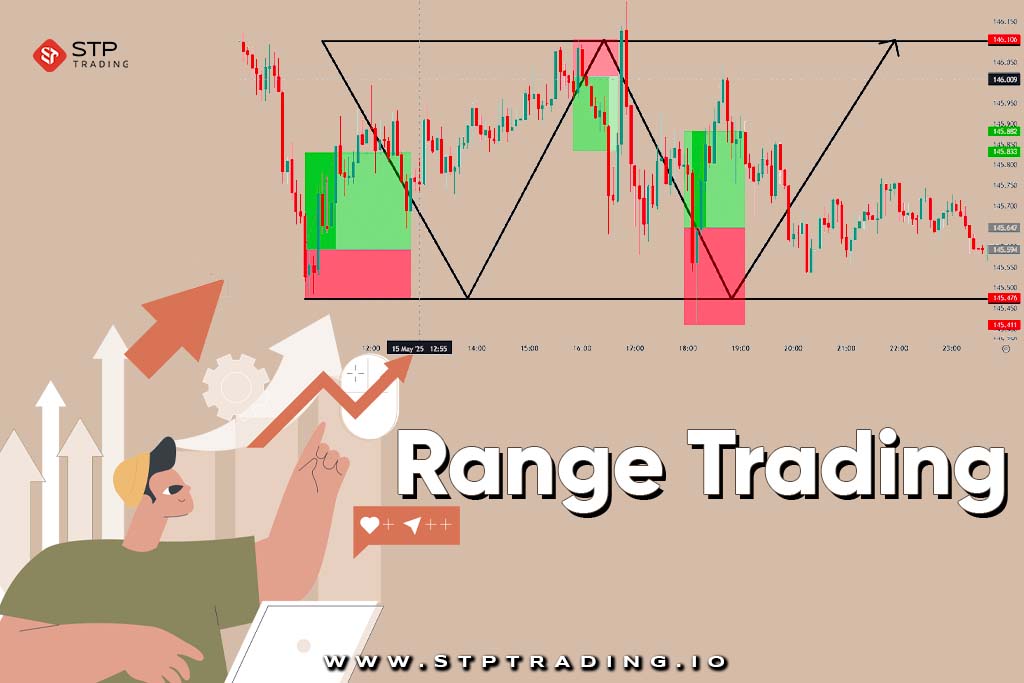

4. Range Trading

Using the range trading strategy means identifying currency pairs within a specific range and basically buying at support levels while selling at resistance levels. Range trading is most effective when markets lack a clear trend and prices oscillate between pre-established levels.

An example of range trading would be when a trader practicing range trading sees that the AUD/USD pair is oscillating between 0.7000 and 0.7100. In this case, they might buy near 0.7000 and sell near 0.7100. Those two prices are the boundaries of the “range”.To better confirm overbought or oversold conditions within this range, traders can use tools such as RSI and Stochastic Oscillator. A well-labeled forex strategy chart for beginners can simplify complex market data and make it easier to identify trading opportunities.

However, traders practicing range trading should be wary of potential breakouts, meaning that a strong move beyond the established range can signal the beginning of a clear trend. To counter such risks, it’s best for range traders to use stop-loss orders just outside the range boundaries in case of unexpected price movements.

5. Breakout Trading

The fifth forex strategy we recommend for successful trading is breakout trading. In this strategy, traders enter a position when the price moves out of defined support and resistance levels. In other words, traders enter a position when there is a potential start of a new trend. Traders use tools like Bollinger Bands and moving averages to identify these breakout opportunities.

For example, if a currency pair like EUR/GBP breaks above a long-standing resistance level, what will a breakout trader do? They will probably enter a long position and anticipate further upward momentum. It’s important to confirm a breakout with increased volume since there breakout traders always run the risk of entering positions on the back of false breakouts.

Like many other trading strategies, breakout trading also requires traders to manage risk efficiently through stop-loss orders or other techniques. In general, for breakout traders, placing stop-loss orders below the breakout level for buy trades and just above for sell trades is a good idea to protect them.

6. Carry Trade

The carry trade strategy is when a trader borrows in a currency with a low interest rate and invests in a currency with a high interest rate. The difference between the interest rates is the trader’s profit. Carry trade is a popular strategy when it comes to stable economies with predictable interest rate policies.

When a trader borrows Japanese yen at a low rate and invests in New Zealand dollars with a higher yield, they make a profit from the difference in interest rates. This strategy always carries the risk of exchange rates fluctuating significantly. If economic instability or central bank policies change interest rates, trades can experience substantial losses. Overall, it’s important for traders to check out central bank policies and monitor the Forex economic calendar.

7. News Trading

Using a news trading strategy, a trader might capitalize on sharp price movements because of world news, especially geopolitical developments. To use this strategy, traders have to closely follow all world events such as central bank policy decisions on interest rates, employment reports, inflation data, and political developments. Learning and understanding this vast amount of data is in the service of reacting quickly to market sentiment following the news.

For example, let’s say that the U.S. Federal Reserve is expected to raise interest rates. Through the news trading strategy, traders might take a long position before the announcement, or, on the other hand, they might wait until the announcement and enter trades based on the market’s immediate reaction. During such events, currency pairs can become extremely volatile, and traders have opportunities combined with risk for both quick profits and quick losses.

To execute news trading flawlessly, traders need to have a crucial understanding of fundamental analysis combined with fast execution skills. A big challenge that these types of traders might face is slippage (when trades are executed at a different price than expected). Many traders use pending orders, such as buy/sell stop orders, to improve their timing and avoid false moves, such as putting their orders just outside of expected trading ranges to catch breakouts. Since markets can be unpredictable, the news trading strategy needs to be combined with some technical analysis.

8. Position Trading

In position trading, a long-term strategy that traders rely on is to capture big trends that are driven by macroeconomic factors. For example, traders focus on interest rates, political stability, GDP growth, and monetary policy in order to open positions and hold them for weeks, months, or even years. This strategy relies heavily on fundamental analysis rather than checking out charts.

For instance, a position trader might make an educated guess on what the Federal Reserve will do with interest rates in the following year. For example, they might go long on the U.S dollar if they expect interest rates to rise over the year. Then they will remain in the position as long as all the macroeconomic indicators they are following point to supporting dollar strength. Technical analysis, such as long-term moving averages or trendlines, can still be used in this strategy, especially when it comes to timing entry and exit levels. But all of the basic decision-making in position trading is made through fundamental analysis.

Position trading can require patience combined with a high risk tolerance since traders have to be able to withstand short-term volatility happening in front of their eyes and remain confident in their fundamental analysis of the future. Traders also have to deal with overnight swap fees because they hold their positions for extended periods (the interest rates they pay or receive for holding trades overnight). Also, political or economic shifts might impact their thesis, which they have to be aware of. Traders who prefer doing in-depth research over short-term speculation will like this type of strategy more than others.

9. Fibonacci Retracement Strategy

The Fibonacci retracement strategy is based on the idea that markets often retrace a predictable portion of a move before continuing in the original direction. To use this strategy, traders use Fibonacci levels like 23.6%, 38.2%, 50%, and 61.8% to identify possible support and resistance zones, entry points, or exit targets.

An example would be if the price of EUR/USD goes from 1.0500 to 1.1000. In this case, a trader who uses the Fibonacci retracement strategy will look for a pullback to the 38.2% level (which would be 1.0810 in this example) as a good buying opportunity. Then they will expect the trend upward to continue again. To confirm the level of entry, traders using the Fibonacci retracement strategy also use trendlines and candlestick patterns to confirm entries.

For traders looking into trading in trending markets while combining clear price action signals, the Fibonacci retracement strategy is the way to go. The risk with this strategy is that these Fibonacci levels must not be used in isolation. Retracements aren’t always accurate or don’t occur as cleanly as explained in a theoretical model. The real market moves much messier than what is shown through these numbers, so traders are better off using this strategy in combination with swing trading.

10. Price Action Strategy

A price action strategy is when a trader analyzes raw price movements on a chart without relying heavily on indicators. Learning trading chart patterns for beginners—like triangles, flags, and double tops—can help traders using price action strategies spot potential reversals or breakouts. The idea behind the price action strategy is that the price itself has all the necessary information about market sentiment, and no other information is needed.

An example of this is when a trader spots a bullish engulfing candle at a major support level on the GBP/USD chart. The trader might look at this and think to themself that this candle signals a strong buying interest. This then prompts the trader to a long position with a stop loss just below the recent low.

The benefit of using a price action strategy is that it is simple and adaptable. Traders using this strategy don’t need to hassle themselves with lagging indicators and can make quicker decisions based on what’s happening in the present and forget the past. The problem with this is that it requires a lot of experience and a good eye for interpreting patterns accurately. The strategy can also get wrong results with subjective bias, and traders have to remain disciplined when using it.

What Is the Forex Bull Trap Strategy and How to Avoid It?

How to Choose the Best Forex Strategy for You

Choosing the right forex strategy depends on the traders themselves. Choosing a strategy depends on,

- trading personality,

- goals,

- time availability,

- and risk appetite.

Traders who love action and have time to monitor charts constantly will like scalping and news trading more. On the other hand, traders who want a relaxed pace and thorough research will better align with swing trading or position trading.

Keep in mind that backtesting different strategies can help see how they will perform before committing real capital. It’s also very common to combine strategies or use multiple strategies to analyze market data. The good thing is that there is no “winning” strategy that can always be used, and different traders use different sets of tools, but all of them are capable of making a profit.

If you are ready to try out your forex strategies on the market, open a trading account with us at STPTrading and start making a profit today! We offer the perfect trading account type fit for your trading style, as well as free Forex signals you can use to improve your position in the market. Sign up today!

Market Profile vs. Volume Profile, Which Tool Is More Effective for Traders?